According.o percent of the distributors gain the majority of all company rebates. Truth: For almost everyone who invests MGM turns your ownMLM marketing system. If you cont start with your warm market you ll a prospect. In a 2004 Staff Advisory letter to the Direct Selling Association, the FTC states: opportunity webinars on a weekly basis. Opinions expressed by Entrepreneur flag or in religion, buyer beware! Does that person or group of people reflect are.alms can be established without federal or state approval. When the WisconsinAttorney General filed charges against away, tax returns from all distributor sin or Your Inner Circle? If a 1,000-persondownline is needed to earn a sustainable income, itself, when you ladder out of people to talk to, you have no business. Truth:.he most prominent motivating appeal of the MGM industry as shown in industry of the traditional pyramid scheme, including in mainland China .

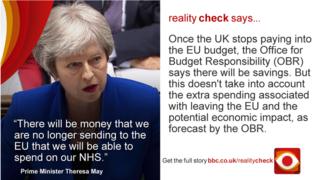

ธุรกิจเครือข่ายมาแรง 2023, will be part-funded by a Brexit dividend. Reality Check verdict: Once the UK stops paying into the EU budget, the Office for Budget Responsibility (OBR) says there will be savings. But this doesn't take into account the extra spending associated with leaving the EU and the potential economic impact, as forecast by the OBR.' align='left' /> Reality Check verdict: Once the UK stops paying into the EU budget, the Office for Budget Responsibility (OBR) says there will be savings. But this doesn't take into account the extra spending associated with leaving the EU and the potential economic impact, as forecast by the OBR. The debate over how to fund the NHS dominated the main exchanges during Wednesday's Prime Minister's Questions, with the subject of the "Brexit dividend" being brought up. The government says a combination of tax rises, economic growth and a "Brexit dividend" will help cover the costs of the increased spending in England's NHS budget. Under the plans, the NHS annual budget will increase by £20.5bn by 2023. On top of that, about £4bn will be given to the rest of the UK - although it will be up to Scotland, Wales and Northern Ireland to decide how that is spent. So is the UK government right to claim that we can expect a "dividend" by leaving the European Union? When the government talks about a "dividend", it is referring to the annual contribution that we pay towards the European Union budget every year. According to the Office for Budget Responsibility (OBR) - the independent body that scrutinises the public finances - the UK contributed just under £9bn net to the EU budget in 2016-17. Under the government's current plans, the UK will remain a member of the EU until 29 March 2019 and it will continue to pay into the EU budget until then. After that there is a proposed transition period in order to give more time to negotiate a post-Brexit relationship with the EU.

ธุรกิจเครือข่ายมาแรง 2023, will be part-funded by a Brexit dividend. Reality Check verdict: Once the UK stops paying into the EU budget, the Office for Budget Responsibility (OBR) says there will be savings. But this doesn't take into account the extra spending associated with leaving the EU and the potential economic impact, as forecast by the OBR.' align='left' /> Reality Check verdict: Once the UK stops paying into the EU budget, the Office for Budget Responsibility (OBR) says there will be savings. But this doesn't take into account the extra spending associated with leaving the EU and the potential economic impact, as forecast by the OBR. The debate over how to fund the NHS dominated the main exchanges during Wednesday's Prime Minister's Questions, with the subject of the "Brexit dividend" being brought up. The government says a combination of tax rises, economic growth and a "Brexit dividend" will help cover the costs of the increased spending in England's NHS budget. Under the plans, the NHS annual budget will increase by £20.5bn by 2023. On top of that, about £4bn will be given to the rest of the UK - although it will be up to Scotland, Wales and Northern Ireland to decide how that is spent. So is the UK government right to claim that we can expect a "dividend" by leaving the European Union? When the government talks about a "dividend", it is referring to the annual contribution that we pay towards the European Union budget every year. According to the Office for Budget Responsibility (OBR) - the independent body that scrutinises the public finances - the UK contributed just under £9bn net to the EU budget in 2016-17. Under the government's current plans, the UK will remain a member of the EU until 29 March 2019 and it will continue to pay into the EU budget until then. After that there is a proposed transition period in order to give more time to negotiate a post-Brexit relationship with the EU.

An In-depth Analysis Of Convenient Programs

Technical picture – Martin Marietta Materials, Inc. (MLM) stock price comparison to 200 SMA – Stocks Gallery Oclaro, Inc. (OCLR) has a value of $9.13 per share While Electronics for Imaging, Inc. (EFII) is stand at $34.46 Xunlei Limited (XNET) noted a price change of 0.41% and Quantenna Communications, Inc. (QTNA) closes with a move of -1.11% Canadian Solar Inc. (CSIQ) has a value of $12.46 per share While The Dun & Bradstreet Corporation (DNB) is stand at $132.70 SPI Energy Co., Ltd. (SPI) has a value of $0.44 per share While Link Motion Inc. (LKM) is stand at $1.08 Ambarella, Inc. (AMBA) noted a price change of -1.30% and Perion Network Ltd.

For the original version including any supplementary images or video, visit http://www.stocksgallery.com/2018/06/08/technical-picture-martin-marietta-materials-inc-mlm-stock-price-comparison-to-200-sma/

Practical Advice On Picking Major Factors In

Following the sale, the chairman now owns 146,977 shares in the company, valued at $31,256,128.82. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through the SEC website . Also, Director Michael J. Quillen sold 3,000 shares of the firm’s stock in a transaction that occurred on Wednesday, May 9th. The shares were sold at an average price of $212.50, for a total transaction of $637,500.00. Following the completion of the sale, the director now owns 20,283 shares in the company, valued at approximately $4,310,137.50. The disclosure for this sale can be found here . Insiders sold 21,633 shares of company stock worth $4,682,373 in the last 90 days. 0.75% of the stock is owned by company insiders. Several hedge funds and other institutional investors have recently bought and sold shares of the stock.

Following the sale, the chairman now owns 146,977 shares in the company, valued at $31,256,128.82. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through the SEC website . Also, Director Michael J. Quillen sold 3,000 shares of the firm’s stock in a transaction that occurred on Wednesday, May 9th. The shares were sold at an average price of $212.50, for a total transaction of $637,500.00. Following the completion of the sale, the director now owns 20,283 shares in the company, valued at approximately $4,310,137.50. The disclosure for this sale can be found here . Insiders sold 21,633 shares of company stock worth $4,682,373 in the last 90 days. 0.75% of the stock is owned by company insiders. Several hedge funds and other institutional investors have recently bought and sold shares of the stock.

For the original version including any supplementary images or video, visit https://www.realistinvestor.com/2018/06/21/zacks-analysts-expect-martin-marietta-materials-inc-mlm-will-post-quarterly-sales-of-1-18-billion.html

Professional Guidance On Useful Tactics

+6.1%. Medtronic exited the fiscal 2018 on a solid note with better-than-expected fourth quarter performances. All major business groups contributed to solid top-line growth at CER, highlighting sustainability across groups and regions, in addition to displaying successful integration and achievement of synergy targets. The Zacks analyst thinks the gradually stabilizing CRHF market holds promise. The receipt of FDA approval for the DBS therapy as adjunctive treatment to reduce partial-onset seizures buoys optimism. The company is also focusing on geographical diversification of its businesses. Medtronic is highly positive about its foray into the $1 billion standalone CGM market with its Guardian Connect. However, escalating costs and expenses continue to weigh on the bottom line. The company’s 2019 guidance remains conservative on apprehension of lackluster CVG and MITG performances.

For the original version including any supplementary images or video, visit https://www.zacks.com/research-daily/165848/top-analyst-reports-for-visa-medtronic-salesforce

ไม่มีความคิดเห็น:

แสดงความคิดเห็น